Event Details

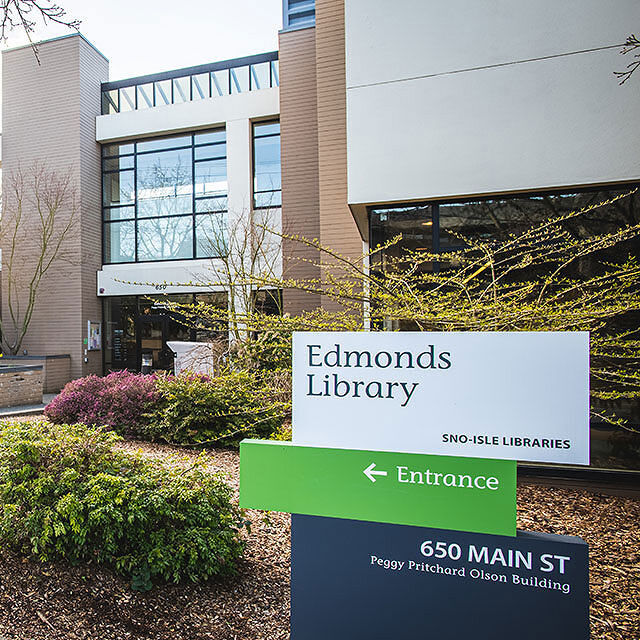

Sno-Isle Libraries – Edmonds Branch

650 Main St

Edmonds, WA 98020

Event Options:

– Tuesday, October 21 at 6:00 p.m. – Wednesday, October 22 at 6:00 p.m.

Seating is limited and there is no charge to attend.

Preparing for retirement has never been so challenging. Join us for an enlightening presentation at Sno-Isle Libraries – Edmonds Branch. We will discuss the latest strategies to help preserve your assets, maximize your retirement income, reduce market risk and potentially lower your taxes.

Here’s what we’ll cover:

Privacy Policy: By providing your email, phone number, and selecting "Yes" for text message reminders, you are consenting to receive communication from Your Retirement Reality. All information provided is secure and confidential. Please provide valid email and phone number for seminar confirmation purposes. Seating is limited. There is no charge to attend!

Do you have a retirement tax strategy in place?

Don’t miss this information-packed event!

If you have an IRA, Roth, 401(k), 403(b) or any other retirement accounts, you don’t want to miss the opportunity to learn about:

These events are extremely popular and seating is limited. Reserve your seat today to guarantee attendance!

Pat and his team of insurance professionals, for over 23 years, have been in the retirement space of offering Tax efficiency Strategies, Legacy Planning, and methods to transfer wealth in the most efficient manner possible. In addition to Social Security, Pension Planning, lifetime income, and retirement strategies, Pat and his team offer a no-cost retirement analysis and should you decide to work with us, access to our tax mitigation team.

© 2025 Taxes Declassified | Privacy Policy

The contents of this email and our website are for educational purposes only. Any material and its attachments, links, downloads, and/or any emails from our company are not intended to provide legal or tax advice. To ensure compliance with requirements imposed by the IRS, we inform you that any U.S. federal or state tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein. Please seek the advice of appropriately licensed individuals for legal or tax advice relating to your individual situation. Birdseye Financial and its employees are not tax or legal advisors and are not operating in such a manner. Birdseye financial and those working for the company are not licensed Investment Advisors which prohibits us from offering such advice. Any advice you get should be taken as non-investment advice and only educational in nature. Should our clients need a licensed investment advisor, we often work with LifePro Asset Management. *Investing carries an inherent element of risk. No strategy can guarantee a profit or prevent a loss. Provided content is for overview and informational purposes only and is not intended and should not be relied upon as individualized tax, legal, fiduciary, or investment advice. Any illustrations used are hypothetical and were used for explanatory purposes only. THANK YOU!

*Information is applicable to all events conducted by its collective members through Taxes Declassified from 2016-2025.

Investing involves risk, including possible loss of principal. Insurance product guarantees are backed by the financial strength and claims-paying ability of the issuing company. We are not affiliated with any government agency.

The information contained herein is based on our understanding of current tax law. The tax and legislative information may be subject to change and different interpretations. We recommend that you seek professional legal advice for applicability to your personal situation.

By providing your information and/or attending this event, you give consent to be contacted about a discussion of life insurance and annuities or a possible advisory relationship. Attend and learn how insurance or investment products can be used in various stages of retirement planning.

The presenter can provide information, but not specific advice related to social security benefits. Clients should seek guidance from the Social Security Administration regarding their particular situation. The presenter may be able to identify potential retirement income gaps and may introduce insurance products, such as an annuity, as a potential solution. Social Security benefit payout rates can and will change at the sole discretion of the Social Security Administration. For more information, please consult a local Social Security Administration office, or visit www.ssa.gov.